Vehicle insurance does decrease at 25. The average cost of vehicle insurance policy for a 25-year-old is $3,207 for an annual policy. By contrast, drivers pay approximately $7,179 at 18 and also $4,453 at 21 which demonstrates that vehicle insurance does drop as you age. This landmark isn't as wonderful as you might think.

When does car insurance obtain less expensive for young motorists? Given they preserve a clean record, young motorists will likely see their automobile insurance go down after every year driving on the road yet how much it really decreases by differs from year to year.

What age does auto insurance go down for male vs women drivers? Your car insurance coverage does go down after you turn 25, however not as much as it does on various other birthdays - cheapest car. Unless you live in a state where insurers can't factor gender right into insurance policy rates, one significant adjustment occur at age 25: the distinction in between what man as well as women motorists pay for car insurance policy.

auto vehicle insurance trucks cheaper

auto vehicle insurance trucks cheaper

Does car insurance from major national insurance firms go down at 25? We analyzed quotes from four of the biggest car insurance provider Geico, State Farm, USAA as well as Progressive as well as located that while auto insurance does drop at 25 with each of them, the quantity it decreases by varies significantly.

Get This Report about Does Auto Insurance Go Down After The First Year?

Unless you live in one of the couple of states that have made it illegal, a lower credit rating might increase your car insurance coverage costs (insurers). If you relocate to an area with higher prices of burglary and also vandalism, then insurance providers will charge you higher costs to represent the raised threat of damages or burglary.

Every insurance policy company determines rates in different ways, and also some insurer will emphasize different elements a lot more heavily than others. We advise reassessing your insurance provider yearly to get the very best rate. Just how to obtain more affordable car insurance as a 25-year-old vehicle driver If you're a young vehicle driver in your 20s, you've likely wondered exactly how to decrease your car insurance policy costs.

cheap car cheap car insurance cheap risks

cheap car cheap car insurance cheap risks

Approaches for exactly how to make your auto insurance coverage drop By the time you hit age 25, you have actually likely passed the factor where you can remain on your moms and dads' insurance coverage. (If you have not, nevertheless, you should certainly do so, considering that this is one of the very best ways for young drivers to save money on their premiums.) There are various other methods for 25-year-olds to obtain their insurance coverage rates to go down.

cheapest car insurance low cost dui cheap auto insurance

cheapest car insurance low cost dui cheap auto insurance

As your cars and truck's value depreciates over time, nevertheless, think about minimizing or getting rid of crash as well as extensive protection. If your auto is only worth a few thousand bucks, it does not make sense to shell out for high costs to cover a possession of limited worth. If you're wed and each of you drives different vehicles, you may be able to reduce your automobile insurance coverage repayment by, as insurance companies think about wedded pairs extra solvent and also risk-averse.

The Buzz on When Does Car Insurance Go Down?

Price cuts for 25-year-old vehicle drivers As you look around for the ideal rate, make certain you're likewise asking insurance provider about all applicable discount rates. Twenty-five-year-old chauffeurs may not have the ability to take benefit of student-away-from-home or good-student plans, but there are lots of other means these young motorists can conserve on cars and truck insurance policy: You may not be able to get approved for a good-student discount anymore, however your university might have partnered with an insurance provider to protect discounts for alumni.

By taking a, you'll not just find out just how to drive even more safely, however you can decrease your car insurance costs anywhere from 5% to 20%. Be suggested, nevertheless, that some states as well as some insurance providers just extend this discount to elders or motorists under 25. Talk to your insurance firm to see if you qualify before you register for a course.

Does your car have particular safety and security attributes, such as anti-lock brakes or daytime running lights? Ask concerning these discount rates when you call insurance policy firms for a quote.

When you initially get your certificate as a teenager, there's a great opportunity you're not spending for auto insurance policy yourself, which is lucky, because those initial few years of being insured are a few of the most expensive of your whole life. Excellent things come to those that wait, and also that's additionally true for the cost of cars and truck insurance, which decreases when you grow older.

The 6-Second Trick For Factors That Affect Your Car Insurance Rates - I Drive Safely

affordable car insurance auto insurance auto insurance credit score

affordable car insurance auto insurance auto insurance credit score

insurance affordable cheaper car insurance vehicle cheapest auto insurance

insurance affordable cheaper car insurance vehicle cheapest auto insurance

As well as while your credit rating, marital condition, and education and learning degree can aid insurance firms determine your degree of danger, age is just one of the biggest aspects. Teenage drivers have a tendency to cause more accidents than older, more seasoned chauffeurs, so insurance coverage business elevate your rates as a result of the high risk variable. Nonetheless, there are things you can do to aid decrease your prices. cheaper car insurance.

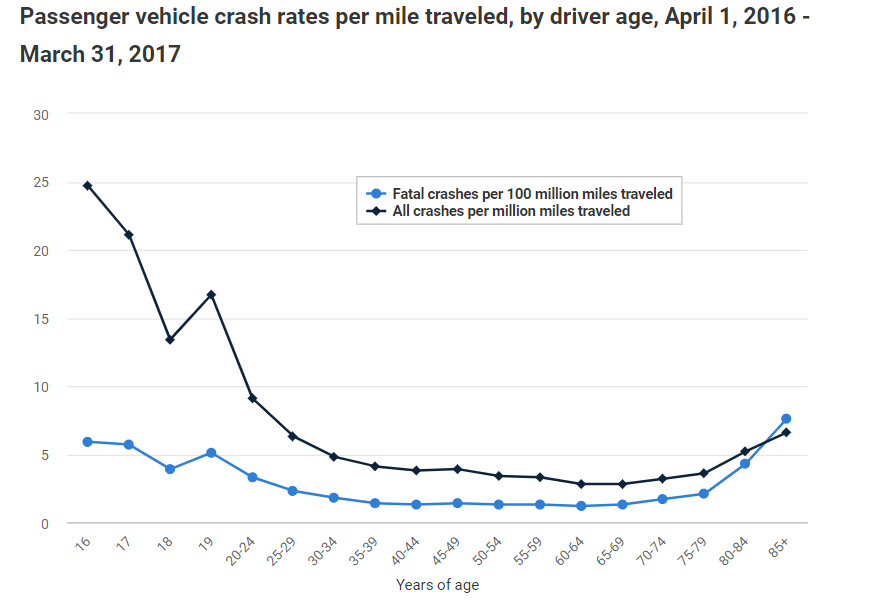

According to the Insurance Policy Institute for Highway Safety, 60 to 64 years of age have the least expensive rate of claims they're relatively good chauffeurs with a reduced mishap price so their insurance policy costs are low - cheaper car. Yet cases prices begin increasing once more for 65 years of age, and also deadly auto accident prices enhance at 70, so those motorists normally will have greater premiums.

Ask your insurer regarding: Excellent trainee price cuts, Excellent chauffeur discount rates, Vehicle security discount rates, Bundling and also plan renewal discounts, Usage based discount rates, that track your driving with an application as well as honor cost savings for secure driving patterns One of the quickest methods to conserve can be to purchase brand-new cars and truck insurance prices quote from various firms (perks).

Often Asked Inquiries, Why does auto insurance policy drop at 25? Vehicle insurer make use of analytical data, among other factors, when determining automobile insurance coverage rates. Because motorists under 25 are much more most likely to get involved in automobile mishaps and also data claims than vehicle drivers over the age of 25, more youthful chauffeurs pay even more.

A Biased View of Does Car Insurance Go Down After Car Is Paid Off?

Many insurers reward secure vehicle drivers with discounts on their costs. Automobile insurance prices can also go up at revival, even if you're gone the entire plan term without any accidents or insurance claims - vans.

Being unskilled behind the wheel generally leads to greater insurance coverage rates, yet some companies still provide great rates - credit. Much like for any kind of other vehicle driver, locating the ideal automobile insurance coverage for new drivers indicates researching https://auto-insurance-loop-chicago-il.us-east-1.linodeobjects.com/index.html and comparing costs from numerous carriers. This overview will certainly offer a review of what brand-new vehicle drivers can anticipate when spending for automobile insurance coverage, who qualifies as a brand-new chauffeur and what aspects form the rate of an insurance coverage.

Each state sets its own minimal automobile insurance coverage requirements, and also vehicle insurance coverage for brand-new vehicle drivers will certainly look the exact same as any type of other vehicle driver's policy (business insurance). While a lack of driving experience does not transform exactly how much insurance coverage you need, it will affect the rate.

As mentioned, age is one of the main variables insurance provider take into consideration when computing prices. Part of the factor insurance provider hike rates for more youthful vehicle drivers is the raised likelihood of an accident. Automobile crashes are the second-highest leading reason of death for young adults in the united state, according to the Centers for Illness Control and Avoidance.

A Biased View of At What Age Does Car Insurance Start To Go Down?

Adding a young motorist to an insurance coverage plan will still increase your costs substantially, but the amount will rely on your insurance coverage firm, the automobile as well as where you live. affordable. Teens aren't the only ones driving for the initial time. An individual of any age who has actually resided in a huge city and largely relied on public transport or who hasn't had the means to purchase an automobile can additionally be considered a new driver.

Also though you may not have experience when traveling, if you more than 25, you might see lower rates than a teen driver. cheapest auto insurance. One more point to think about is that if you reside in a location that has public transportation or you do not prepare on driving much, there are choices to typical insurance, like usage-based insurance coverage.

Immigrants as well as international nationals can be categorized as brand-new drivers when they initially get in the U.S - car insured. This is due to the fact that automobile insurer generally check domestic driving documents, so you can have a tidy driving record in one more nation and also still be thought about an unskilled driver after transferring to the States.

We recommend utilizing the adhering to strategies if you're purchasing automobile insurance coverage for new chauffeurs. Compare companies No 2 insurance firms will certainly give you the exact same rate.

Facts About What Can Raise Or Lower The Cost Of Your Car Insurance- Aaa Revealed

Our recommendations for vehicle insurance coverage for new vehicle drivers Whether you're a new driver or have actually been driving for decades, investigating and also contrasting quotes from a number of carriers is a terrific way to locate the finest rate. Our insurance specialists have actually discovered that Geico and State Farm are excellent options for auto insurance policy for brand-new chauffeurs. car insurance.

The end result was a total score for every carrier, with the insurance firms that racked up one of the most points topping the checklist. In this post, we selected companies with high total rankings as well as price rankings, along with those with programs targeting new and novice drivers (suvs). The price ratings were informed by auto insurance price quotes generated by Quadrant Information Solutions as well as discount rate opportunities.

It's restricted to three years in Virginia as well as isn't offered in all states. The premium may transform if the policy and its protections are altered. Here are some cars and truck insurance coverage price cuts and client incentives that might relate to you or others in your household: Multi-policy Discounts, If you insure multiple automobiles or have several authorities with ERIE (life insurance policy or house policy plus auto insurance), price cuts could use.

1First Mishap Forgiveness, Everybody is entitled to a second chance, right? Well, ERIE provides First Mishap Forgiveness, indicating you won't be surcharged the very first time you're at fault in an accident after you have actually been an ERIE client for 3 or more years. auto. (The three-year wait does not use in all states. Accident Mercy does not apply when the Rate Defense Endorsement is on the plan.) 2Diminishing Insurance Deductible Alternative, You haven't submitted any type of insurance claims and have the record to show it? Look into ERIE's Diminishing Deductible alternative, available in the ERIE Auto Plus Recommendation.

6 Easy Facts About Why Did My Car Insurance Go Up For No Reason? - Cover Shown

Eligibility varies by state, so make certain you certify by getting in touch with your representative. Car Storage, Maybe you wish to keep your vehicle out of the bad winter season weather, or maybe you're flying to a warmer location for a while. Whatever the factor, if you prepare to keep your lorry for 90 consecutive days or more, ERIE supplies a reduced use price cut in the majority of states. credit.

So, it stands to reason that the safety features in your vehicle will settle in the type of discount rates. Factory-installed air bags, anti-theft gadgets as well as anti-lock brakes are some of the safety includes that will repay for you in more means than one. Payment Advantages, Spending for your vehicle insurance policy in installations can be practical and useful for the budget conscious. auto insurance.

And after that there's the expense of adding one more motorist to the plan. ERIE uses a number of price cuts that might use to your family if you have new chauffeurs.

ERIE provides up to $75 per passenger in the automobile for traveling costs if you don't reach your destination and aren't near house. That will absolutely aid with your dinner as well as resort space. Your cherished household pet dog could be traveling with you, as well as ERIE appreciates your pets and pet cats.